Empowering Gig Workers: Innovative Credit Solutions for Growth

A gig worker may complete hundreds of deliveries each month, never miss a shift, and consistently support the economy — yet when he applies for a loan, he’s denied.

Why? Because he doesn’t have a traditional credit score.

This is the challenge faced by millions of gig economy workers today. Their hard work and reliability often go unrecognized in conventional financial systems, limiting their access to credit and growth opportunities.

We had the privilege of hosting HAJIME YANAI san from Toyota Tsusho Corporation, Japan, along with Ashwin B.S. from ResearchFox Consulting, at our Hyphen SCS office in Noida to discuss an innovative approach to solving this.

In collaboration with GMS Corporation , Toyota Tsusho is building a solution that leverages telematics data — analyzing:

✅ Number of orders fulfilled

✅ Trips & deliveries completed

✅ Driving & operational patterns

✅ Consistency & reliability

…to create a fair, holistic creditworthiness profile for gig workers.

This not only enables financial inclusion but also opens doors for lending partners and institutions to make more informed, responsible decisions.

At Hyphen SCS, we are excited about the potential synergies in co-creating a sustainable, optimized, and inclusive ecosystem — one that empowers gig workers while enabling businesses to thrive.

🙏 Thank you, Yanai-san and Ashwin, for the inspiring exchange of ideas.

Together, we can redefine the future of work, finance, and logistics.

arunpandit.com

hashtag#ToyotaTsusho hashtag#ResearchFox hashtag#HyphenSCS hashtag#GigEconomy hashtag#FinancialInclusion hashtag#Telematics hashtag#CreditAccess hashtag#Logistics hashtag#Sustainability hashtag#FutureOfWork hashtag#Japan hashtag#India hashtag#arunpandit

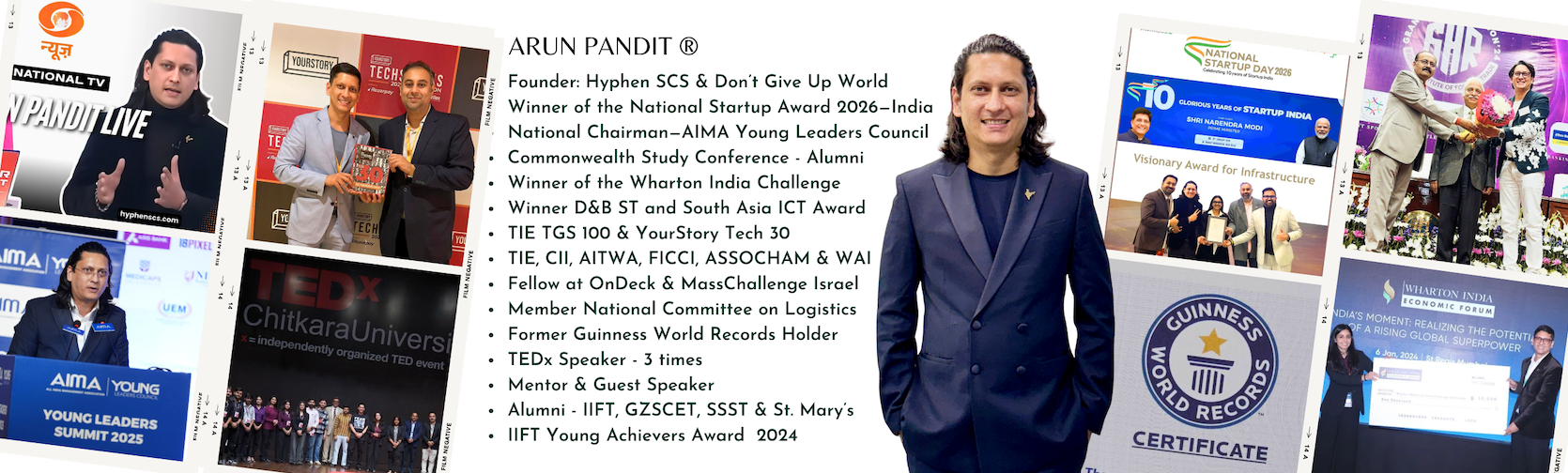

Arun Pandit (R) The official website of Arun Pandit

Arun Pandit (R) The official website of Arun Pandit